Hands on experiences

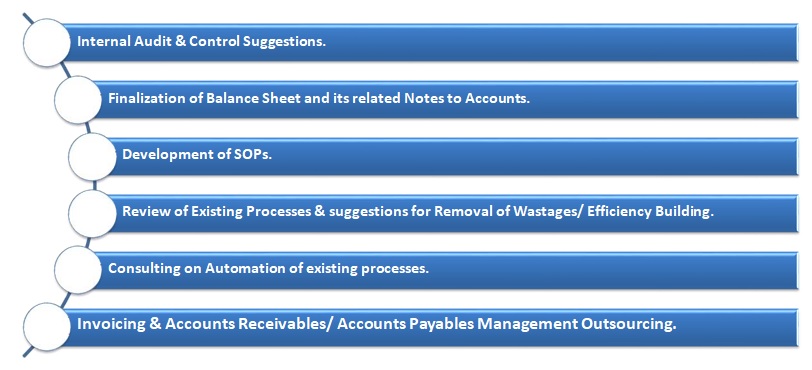

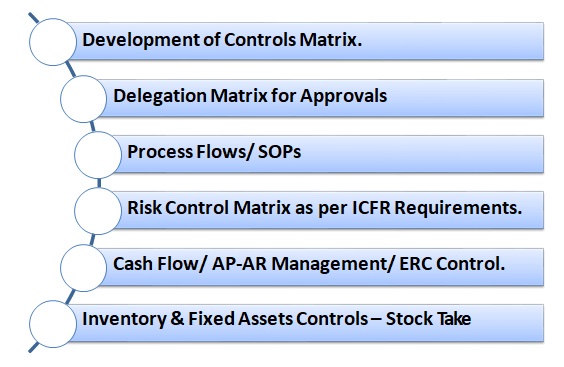

In Statutory audit/ Internal audit/ Accounts & Commercial Outsourcing / Payroll Outsourcing/ AP-AR Management / Cost Audit of almost all verticals of various businesses through below team:

FCA KTS Anand having 40 years of experience is the leading co associate partner engaged in helping the structure to have Tax Haven Zone Registration of entities & bringing Global Tax Stature & its benefits apart from Arranging Funds.

FCMA NN Sharma having 30 years of experience, worked in various companies & has worked with all Big4 closely & can add value to the company in creation of Systems/ Processes/ SOPs & building the efficiency in structure by having robust Audits/ Compliances & Procedures Implementation.

FCA Sanjay Goel with 20 years + experience in dealing with GST & all Statutory Compliances & in Tax Planning.

FCA Vijay Singh with 10 years + experience, associate partners is offering services like Statutory Audit, Internal Audit, System Audit & TaxAudit & Tax Advisory Services.

ACA Shivangi Mittal with 9+ years.

FCS Sachin Soni, handling ROC/ RBI/ FEMA/ DGFT & Other Government Agencies handling.

FCMA JP Sharma having 20 years+ experience, associate partner is deeply involved into Cost Accounting & Audit, Product Costing & in laying down the System Costing System.

ACMA Jitender, involved in Costing & MIS Development & Stock Management.

Ajay Parmar, Sandeep Tyagi & Christopher Fernandes involved in handing complete Accounts Outsourcing Working, Client Interaction, Banking/ Commercial Activity of Client for the clients, having 30 years + experience.

TaxPro Global team of 18 members, qualified & semi qualified are well versed with various software to use, we have deep knowledge of working with Big4 and to deliver Value Add Services for the management.